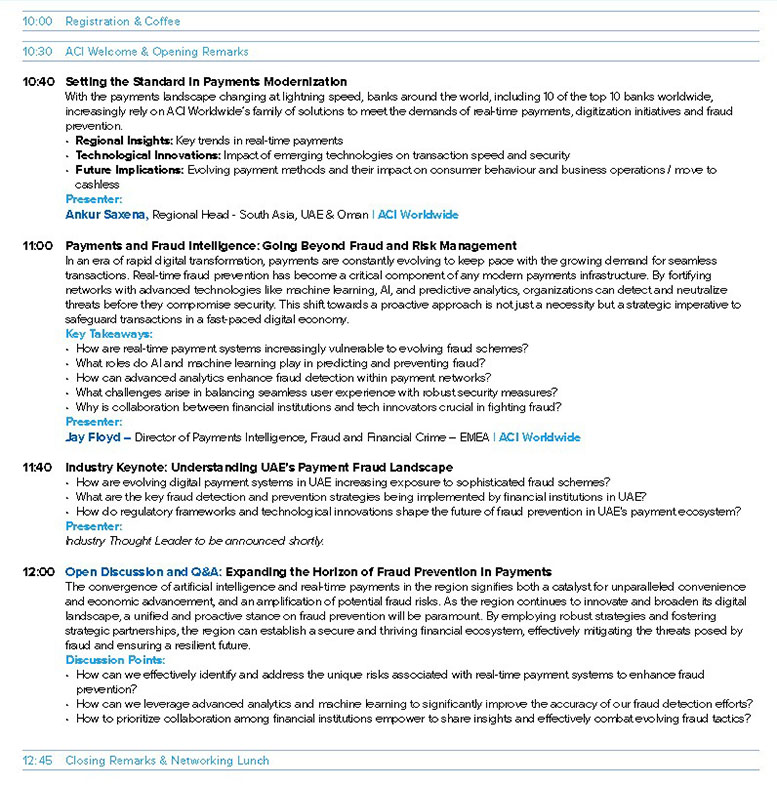

The Superpower of Super App: Time to ACT, Super Apps the new norm.

Imagine chatting, messaging, image sharing, banking, buying tickets, booking hotels, paying bills, and accessing various digital services in just one application.

This is what a Super App is capable of; it is a one-stop application that can fulfill consumers’ diverse needs through a single-user account and a robust in-app payment system.

The rise of Super Apps is reshaping the digital landscape and creating a new paradigm for how services are bundled and delivered to users. It represents a significant growth opportunity for consumer businesses.

A Super App is a mobile or web application that provides end-users with core features plus access to independently created mini-apps within a single platform. It is built as a platform to deliver a mini-app ecosystem that users can choose from to activate for consistent and personalized app experiences. Unlike traditional apps that are designed for a specific function, Super Apps aim to offer a comprehensive user experience by integrating multiple services such as messaging, payments, shopping, social networking, and more.

Key characteristics of a Super App

- Multi-functionality: It offers a broad range of services, from communication and social networking to e-commerce, banking, and utility payments.

- Integrated ecosystem: Acts as a platform for various mini-programs or third-party services, allowing users to access many functionalities without leaving the app.

- User-centric design: Focuses on creating a seamless and convenient user experience by reducing the need for multiple apps.

- High engagement: Encourages frequent use through a wide array of services, increasing user retention and engagement.

- Scalability: Can easily integrate new services and features to adapt to changing user needs and market trends

Benefits of a Super App

- Convenience: Users can perform a wide range of tasks within a single app, saving time and effort.

- Enhanced user experience: Provides a seamless and integrated experience, reducing the need to switch between multiple apps.

- Increased engagement: A broad service offering keeps users engaged for extended periods.

- Data insights: Aggregates user data across various services, providing valuable insights for personalized marketing and service improvement

Why should banks explore Super Apps?

On average, a user has 40 apps installed on their smartphones, including their banking apps. However, these users spend 89% of their time only on 18 apps, leaving other apps dormant. This makes mobile real estate extremely important for banks. Banks can ensure that consumers actively use their apps by proactively providing more interactive and personalized products to customers on their apps.

A Super App is a win-win-win situation for all of its stakeholders—banking platforms, merchants, and end users.

This approach increases user engagement and opens up new revenue streams. For instance, the app might add features like travel booking or food delivery, leveraging its existing user base to gain traction in new markets quickly.

However, the success of Super Apps hinges on more than their owner’s market cap or ability to aggressively expand into other industry sectors. The Super Apps that will conquer the market are the ones that will be relevant to users. To stay relevant, these apps need to understand and anticipate user needs, which requires collecting and maintaining a rich database of user interactions and preferences. However, this presents a significant challenge in a world increasingly concerned with privacy.

A Super App’s success depends on the platform owner’s distribution and brand equity. Banks have an inherent advantage when it comes to trust and distribution. Consumer tech companies build trust and distribution by spending billions of dollars. Once they have distribution and trust, their focus shifts to monetization, which requires building engagement via varied use cases – hence, the rise of Super Apps. High user engagement translates to more habitual use, which, in turn, can help achieve higher retention. Banks, on the other hand, already enjoy trust and distribution due to the very nature of their business. This allows them to leverage these factors to add new use cases rapidly.

Banks need to act now!

With increasing smartphone adoption and internet penetration, the digital economy is booming. More and more products and services are finding their place in the digital market. Banks remain at the forefront of capturing the burgeoning new-age economy, primarily because of their distribution and trust.

- Context-based promotions: By utilizing non-intrusive and consented phone signals, these can detect the ‘best moment of engagement’ per the specific phone user, such as when a customer just left the office at the end of the workday and pop-up targeted timely promotions to order a meal that fits individual’s lifestyle, that will reach home just in time for dinner, creating a highly personalized and timely engagement.

- Wealth management personalization for finance services involves providing wealth management and investment advice based on models that use on-phone signals and app data to predict and understand financial profiles, income levels, lifestyles, risk appetites, and spending patterns. These models can offer highly personalized investment strategies and financial planning services, increasing client satisfaction and retention.

- Enhanced advertising: These can generate hyper-personalized ads based on user behavior and context, leading to more effective campaigns. For example, they can deliver personalized and context-aware ad campaigns tailored to individual user habits and preferences, served precisely at the right time and place.

The Future of Super Apps

Super Apps Banking players across the globe have recognized the changing dynamics and have acted upon it by incorporating use cases starkly different from their core banking services and products to strengthen their market position and capture maximum consumers in the digital economy.

As the digital world continues to evolve, the need for personalized, context-aware, and timely interactions will only grow. Modefin provides the tools necessary to meet these demands without compromising user trust. Super apps that leverage this technology will stay relevant and lead the way in the next generation of digital services.